Small Business Tax: S-Corporation

Service Description

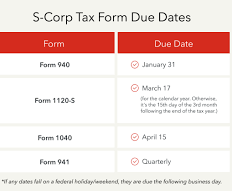

Preparation and filing of federal and state income tax returns for S-Corporations, including Form 1120-S and K-1 preparation for shareholders. Specialized handling of real estate or cryptocurrency tax issues. Pricing: ∙ Basic S-Corp Filing: Starting at $800 (for simple filings with low transaction volume and single K-1). ∙ With Real Estate Transactions: Starting at $1,000 (includes depreciation schedules or real estate-specific deductions). ∙ With Cryptocurrency Transactions: Starting at $1,100 (includes reporting for crypto transactions; increases with complexity, e.g., staking or NFT transactions). ∙ Complex Cases: Starting at $1,500 (for multiple K-1s, high transaction volumes, or complex real estate/crypto scenarios). DEPOSIT: 50% of the estimated service fee (online deposit will be $75 to reserve appointment. This will be applied to the full service fee).

Contact Details

80 M St SE, Washington, DC, USA

202-430-5058

info@jecigroup.com